Fast Pay Freight Factoring

for Owner Operators

Same-day invoice funding. No loans. No long waits.

Just fast, reliable cash flow with a 1.5% intro rate* for Owner-Operators.

Just fast, reliable cash flow with a 1.5% intro rate* for Owner-Operators.

*First 60 days, 1-year recourse contract + 95% advance rate, does not apply to Sprinter Vans or Boxed Trucks.

Get Started with No Credit Check.

"*" indicates required fields

Why Owner Operators Choose Porter Freight Funding

Running your truck shouldn’t mean waiting weeks to get paid.

At Porter Freight Funding, we help owner-operators turn delivered loads into fast, reliable cash flow — so you can pay for fuel, maintenance, permits, insurance, and everyday operating costs without taking on debt or sitting idle waiting on brokers.

How Freight Factoring Works

Owner Operator freight factoring means you:

Step 1

Deliver your load and submit the invoice.

Step 2

Porter buys your invoice and advances most of the total immediately.

Step 3

We handle collections, credit checks, and follow-ups.

Step 4

You get the rest minus our small fee once your broker pays.

It’s not a loan — it’s your money, paid faster.

Why Porter Freight Funding Is Different

Porter Freight Funding isn’t just another factoring provider, we’re a financial partner tailored to the trucking community:

- Industry-Focused

- We design solutions specifically for Owner Operators.

-

- Transparent Pricing

- No surprises. Flat affordable rates with volume-based advantages.

-

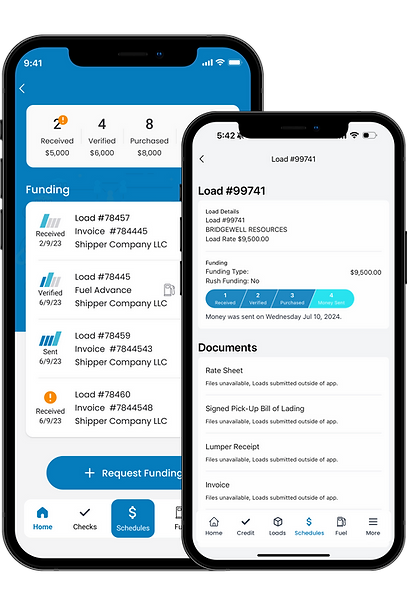

- Powerful Tools

- Online portal + mobile app to upload invoices instantly.

-

- Dedicated Support Team

- Personal account managers who understand your business.

-

- Extra Savings

- Add fuel advances and fuel cards to stretch your operating dollars even further.

Special Offer: 1.5% Introductory Factoring Rate

For eligible Owner Operators, Porter Freight Funding is offering a limited-time 1.5% introductory rate:

Here’s what you get:

- 1.5% factoring fee for your first 60 days

- Up to 95% invoice advance

- Same-day funding available on approved invoices

- Flexible, transparent pricing with no hidden costs

*First 60 days, 1-year recourse contract + 95% advance rate, does not apply to Sprinter Vans or Boxed Trucks.

Freight Factoring Rate Quote

Fast, transparent, and tailored for Owner Operators.Answer a few quick questions to get your best factoring rate.